Large Coffee Plants vs. Micro Roasteries: Lessons from Coca-Cola and Costa in the Global Coffee Market

Introduction

The global coffee roasting market has undergone major shifts over the past decade. Demand for specialty and freshly roasted coffee has increased, especially in Asia and the Gulf region. Research shows the market was valued at $1.27 billion in 2022 and is expected to reach $2.13 billion by 2030, with an annual growth rate of 6.5%.

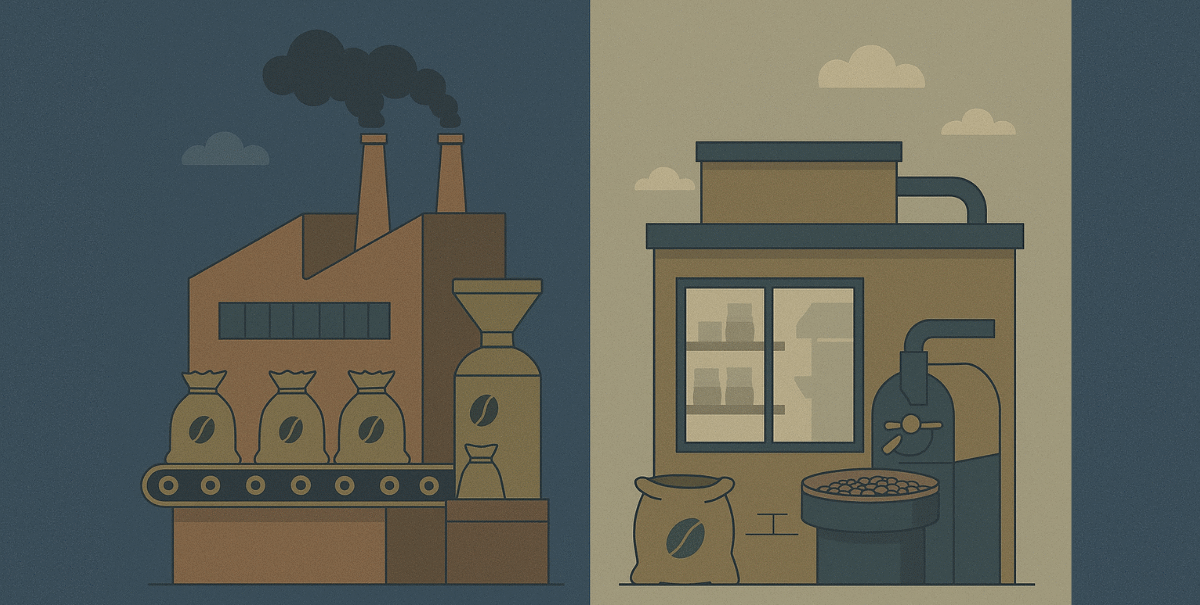

Within this evolving landscape, strategies vary between large plants relying on massive production and distribution, and micro roasteries focusing on quality, agility, and direct customer relationships. Coca-Cola’s journey with Costa Coffee is a prime example of the challenges large-scale expansion can face without flexibility.

Coca-Cola and Costa Coffee’s Journey

In 2019, Coca-Cola acquired the UK-based Costa Coffee for about $5.1 billion, aiming to diversify beyond soft drinks. Despite the ambitious move, several challenges arose:

- UK sales dropped by 1% in the last quarter and 3% for 2024 overall, with pre-tax losses of £9.6 million.

- Global coffee prices surged, with Arabica exceeding $4.30 per pound, putting pressure on profit margins.

- Expansion into the US market through ready-to-drink products and vending machines had minimal impact.

- Costa Express self-service points generated eight times more profit than traditional cafes.

- Coca-Cola began “rethinking” its coffee strategy after realizing large-scale expansion wasn’t delivering expected results.

This highlights that scale and capital alone don’t guarantee success in a dynamic market.

Pros and Cons of Micro Roasteries

Advantages

- Quick product innovation and adaptation.

- High quality control through small-batch roasting.

- Strong direct relationships with customers.

- Commitment to sustainability and direct sourcing from farmers.

Challenges

- Limited production capacity restricts meeting high demand.

- Higher per-unit production costs compared to large plants.

- Greater reliance on local markets or e-commerce channels.

Specialty Coffee Association data shows roasteries combining wholesale and retail achieve higher profits than retail-only operations.

Model Comparison

| Aspect | Large Plants | Micro Roasteries |

|---|---|---|

| Production Volume | Very high | Limited |

| Unit Cost | Low | High |

| Flexibility & Innovation | Low | High |

| Quality Control | Medium to High | Very High |

| Market Responsiveness | Slow | Fast |

| Profit Margins | Volume-dependent | Higher with diversification |

| Supplier Relationships | Wide supply chains | Direct to farmers |

Global Market Trends

- Rising demand for specialty coffee, especially among younger consumers.

- Increasing interest in sustainability and ethical sourcing.

- Emerging markets in Asia and Africa present growth opportunities for both models.

- E-commerce and delivery services are narrowing the distribution gap between large and small operators.

The Role of Technology

In large plants

- AI-powered supply chain systems to reduce waste and optimize inventory.

- High-efficiency automated roasting lines to lower costs.

- Advanced analytics to forecast demand and develop targeted products.

In micro roasteries

- Smart small-batch roasters for precise control over roast profiles.

- Integrated e-commerce platforms for expanded reach.

- Low-cost digital marketing tools, like social media, to boost brand visibility.

Practical Recommendations

For large plants

- Establish in-house micro roasting units for rapid innovation.

- Invest in self-service solutions like Costa Express.

- Offer localized products tailored to specific markets.

- Improve cost and sourcing management to mitigate coffee price volatility.

For micro roasteries

- Collaborate with other roasteries for bulk purchasing.

- Expand via e-commerce to reach new markets.

- Build a strong brand story centered on quality and origin.

- Use advanced roasting technologies to enhance efficiency.

Conclusion

Coca-Cola’s experience with Costa Coffee shows that scale alone doesn’t ensure success. Large-scale expansion offers massive production power but can become a liability without flexibility. Micro roasteries excel in agility and quality but face production limits. The optimal path forward may be a hybrid model that combines the strength of large plants with the innovative agility of small roasters, ensuring a sustainable and competitive coffee industry.

Leave a Reply